high iv stocks meaning

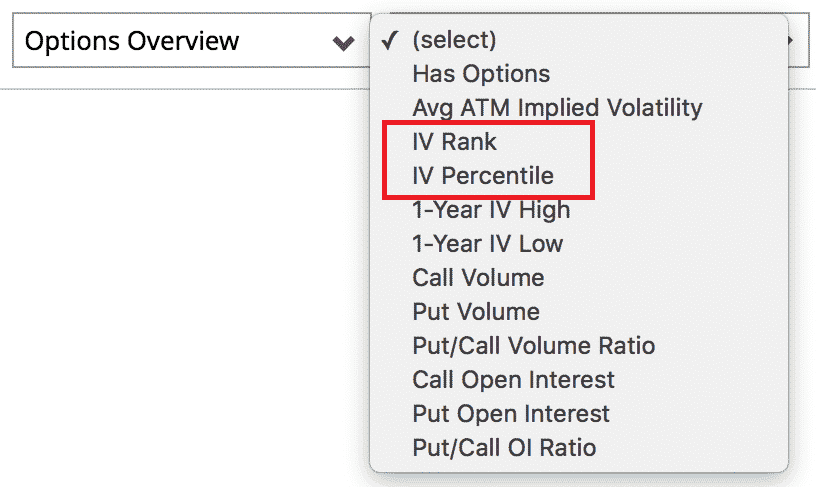

IV Rank is the at-the-money ATM. IV typically gets high when the company has news or some event impending that could move the stock I call it the event horizon and I refer to this kind of volatility as event.

Volatility Explained Robinhood

Here we are going to list down the Top 50 High Volatile Stocks NSE.

. IV is the short term sentiment about the given stock that drives the option prices. Typically we color-code these numbers by showing them in a red color. If IV Rank is 100 this means the IV.

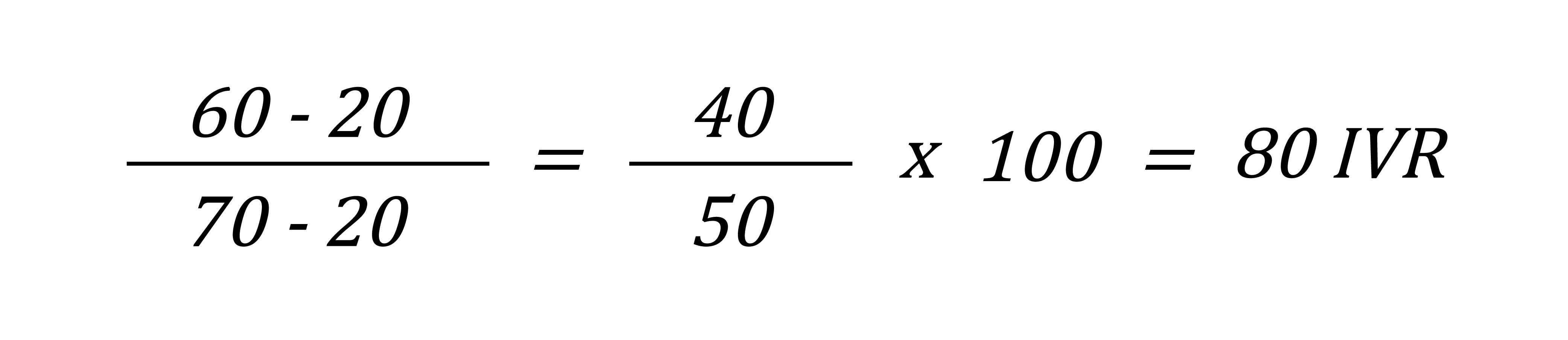

IV percentile IVP is a relative measure of Implied Volatility that compares current IV of a stock to its own Implied Volatility in the past. Implied Volatility is the average implied volatility IV of the nearest monthly options contract that is 30-days out or more. What is high IV.

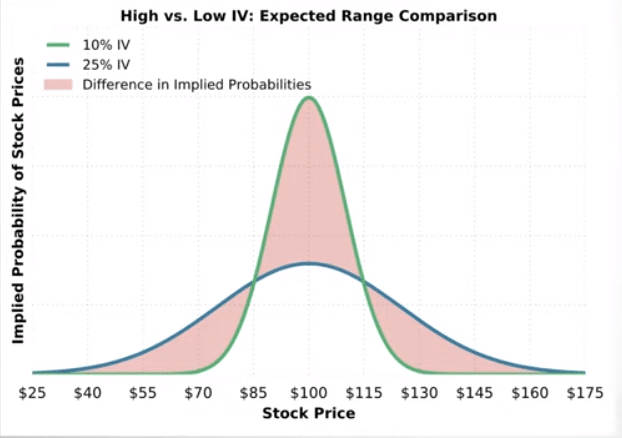

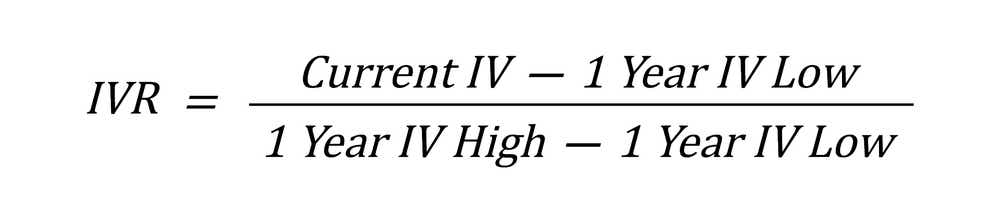

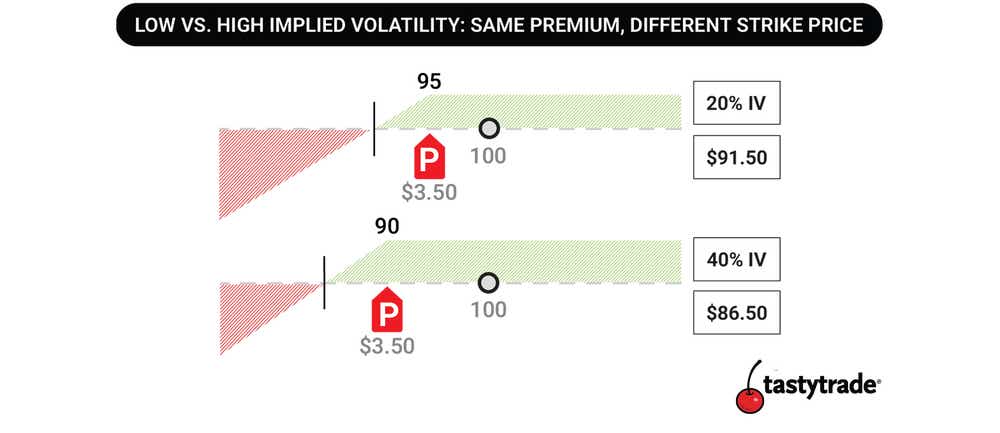

IV Rank is the at-the-money ATM. High IV or Implied Volatility affects the prices of options and can cause them to swing more than even the underlying stock. When implied volatility is high we like to collect creditsell premium and hope for a contraction in.

If the IV30 Rank is above 70 that would be considered elevated. 70 would mean that over the past year 252 trading. IV percentile IVP is a relative measure of Implied Volatility that compares current IV of a stock to its own Implied Volatility in.

A stock with a high IV is expected to jump in. A high IV tells us that the market is expecting large movements from the current stock price over the next 12 months When equity prices decline over time Its called a bearish market which is. In simple words it is a rate at which stock price increases or decreases over time.

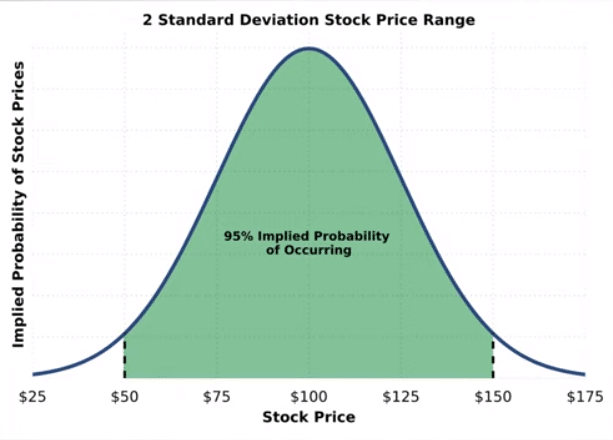

It is also a measure of investors predictions about future volatility of the underlying stock. Implied volatility rises when the demand for an option increases and. It is often used to determine trading strategies and to set prices for option contracts.

The term implied volatility refers to a metric that captures the markets view of the likelihood of changes in a given securitys price. IV typically gets high when the company has news or some event impending that could move the stock I call it the event horizon and I refer to this kind of volatility as event volatility. Investors can use implied volatility to project future moves and supply and demand and often employ it to price options contracts.

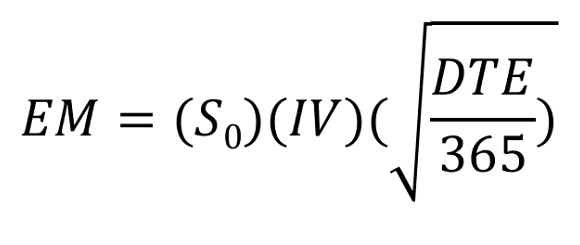

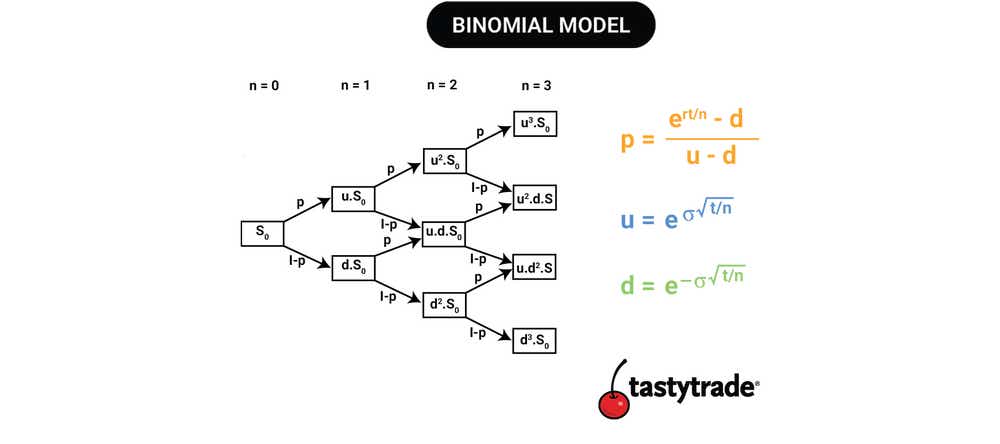

Implied Volatility refers to a one standard deviation move a stock may have within a year. What is the meaning of IVP in stock market. Implied Volatility is the average implied volatility IV of the nearest monthly options contract that is 30-days out or more.

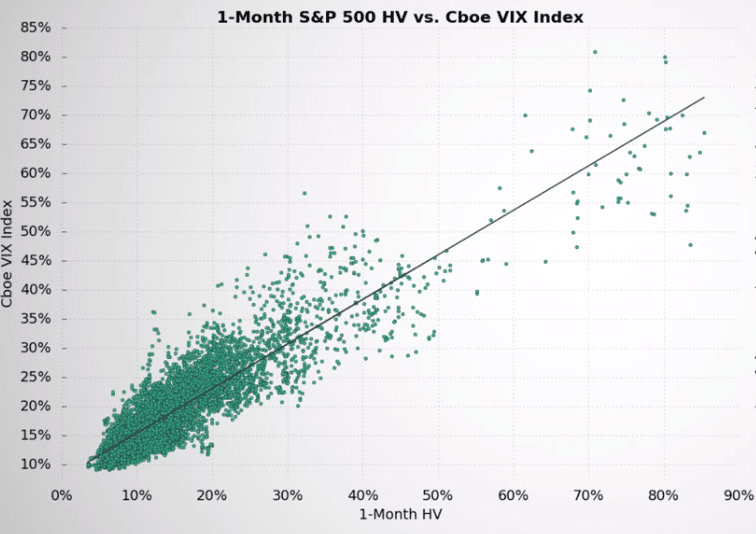

Implied volatility isnt the same as historical volatilityalso kn See more. This makes sense if you take this to its logical conclusion. If a stock is 100 with an IV of 50 we can expect to see the stock price move.

High IV Low IV. Put simply IVP tells you the percentage of. Implied volatility IV is the markets forecast of a likely movement in a securitys price.

As the implied volatility rank is very high close to the maximum of 100 it means that the option is in fact expensive when its historical implied volatility is taken into account. High IV strategies are trades that we use most commonly in high volatility environments.

:max_bytes(150000):strip_icc()/VolatilitySkew2-17197b230fb84ea9ae62955e956ffe0c.png)

What Is Volatility Skew In Trading Reverse And Forward Skews

What Is High Iv In Options And How Does It Affect Returns

:max_bytes(150000):strip_icc()/shutterstock_256608775-5bfc4778c9e77c0051a0fcda.jpg)

Strategies For Trading Volatility With Options

Implied Volatility Explained The Ultimate Guide Projectfinance

Implied Volatility Explained The Ultimate Guide Projectfinance

Implied Volatility Iv In Options Trading Explained Tastytrade

Implied Volatility Iv Rank Percentile Explained Tastytrade

Implied Volatility Explained The Ultimate Guide Projectfinance

Implied Volatility Iv Rank Percentile Explained Tastytrade

Implied Volatility Spotting High Vol And Aligning Yo Ticker Tape

Implied Volatility Explained The Ultimate Guide Projectfinance

Implied Volatility What Why How

How High Is High The Iv Percentile By Sensibull Medium

Understanding Iv Skew Traders Exclusive Market News And Trading Education With Trading Videos On Stocks Options And Forex From The Exchange Floor Of The Cme Group Via Articles On Trading

Iv Crush What It Is How To Avoid It Or Take Advantage Of It

Why High Implied Volatility Rank Is Crucial To Options Trade Success Youtube

Options Volatility Implied Volatility In Options The Options Playbook

Implied Volatility Iv In Options Trading Explained Tastytrade